For a long time, consumers have tolerated the lack of technology found at traditional banks. But with fintech on the rise, banks are struggling to keep up and offer customers the innovation they crave. The question is, will it be fintech vs. traditional banks? Or can they join forces to build financial services that modern consumers are looking for?

Studies from Statista show that from 2018 to 2021, fintech companies in the EMEA region have tripled. In 2021, a total of $210 billion was invested globally across mergers & acquisitions, private equity, and venture capital into fintech startups.

Fintech vs. traditional banks: what’s the difference?

The role of both fintech and traditional banks is to provide seamless financial services to consumers; that’s the only similarity.

Fintech’s are considered the bank’s biggest competitors though they fully complement each other. The financial system banks use traditional and old-fashioned practices and procedures. It’s more often time-consuming and glitchy than it is frictionless. As consumer demands shift to wanting things faster and easier, people are looking for a financial solution that meets their needs.

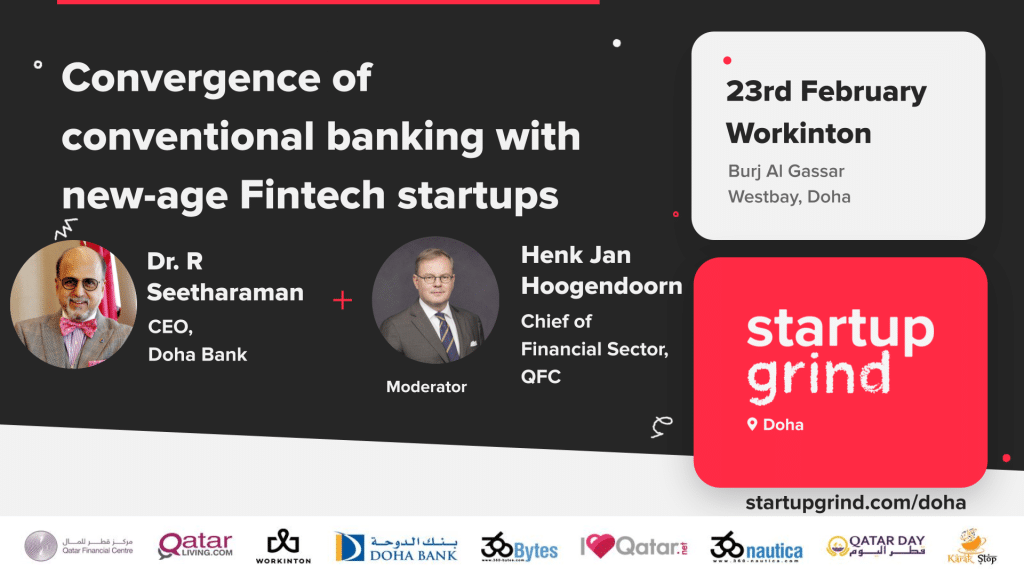

On 23rd February 2022, Startup Grind Doha is hosting a fireside chat at Workinton, Westbay with Dr. R. Seetharaman, CEO – Doha Bank, and Henk Jan Hoogendoorn (Moderator), Chief of Financial Sector Office, Qatar Financial Center to know more about the Fintech scenario in the State of Qatar and if we will see a possible collaboration between Fintechs and traditional banks

Henk is the Chief of Financial Sector Office at QFC, where he is responsible for delivering on QFC’s mission of attracting financial and regulated businesses to Qatar through the QFC platform, in line with the Second Financial Strategy and Qatar National Vision 2030. He has extensive experience in international finance, management, and transforming and building businesses in the financial sector. Henk has held senior management roles at ABN AMRO Bank and Deutsche Bank in the Netherlands and the Middle East and has a solid track record of implementing businesses in the financial sector.

Dr. R. Seetharaman, Chief Executive Officer of Doha Bank since 2007, is a prominent personality in the banking industry throughout the Middle East, an economic expert who has achieved remarkable success for his contributions to Banking, Trade, Investment, Economics, Environment, Social responsibility, Philanthropy, and Charity.

In 2017, he was recognized and conferred by the Government of India with the prestigious Pravasi Bharatiya Samman Award, the highest honor conferred on overseas Indians by the Government of India. He was also honoured with the “Green Economy Visionary Award” in 2016 by the Union of Arab Banks and a“Global Excellence Award in Renewable Energy 2017” by the Energy and Environment Foundation.

Workinton (Venue Sponsor for Startup Grind) is an innovation–driven coworking hub with near 20,000sqm of space worldwide, from Turkey to San Diego to Berlin, and with more than 3200 sqm in Qatar; from Alfardan Centre, Westbay, Lusail, and Msheireb. Complete with colorful and modern office spaces designed for startups, investors, SMEs, freelancers, and corporates.